40+ Refinance mortgage how much can i borrow

Your home value has increased considerably. Blended Rate Calculator Calculates a first and second mortgage blended rate.

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

. How much house you can afford will mainly depend on the following. The discharge fee will generally cost between 100-400. We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

My family and I could not be where we are today without this amazing team. Most mortgage loans require a. Used to fund the FHA program.

- Mortgage refinance - Renovations - Aged care RADs DAPs - Income stream or a capped lump sum advance payment. How much can I borrow. Liabilities and mortgage terms affect the loan amount you can borrow.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. How Much Money Can I Get from a Cash-out Refinance. Lenders generally prefer borrowers that offer a significant deposit.

How Much Can You Afford to Borrow. A standard valuation fee alone can be between 200-500. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan.

Not licensed in all 50 states. When to consider a refinance of your reverse mortgage. Advanced Option ARM Calculator with Minimum Payment Change Cap.

Inflation has been the highest in 40 years and. The Latest from our Partners This Years Best High-Interest Savings Accounts. Assuming a 30-year mortgage that amount of 630000 can then be used to gradually pay for his mortgage over the next 360 months.

To get approved for a cash-out refinance your DTI ratio should be no higher than 50though some lenders might require a ratio as low as 40. Your total interest on a 700000 mortgage. However if the value has changed significantly you may need to provide deposit up to 10 of the propertys value.

They typically request at least 5 deposit based on the value of the property. How Much Can I Even Borrow. The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. How to borrow from home equity. It makes sense to compare loan limits to know how much you can borrow.

You can refinance your mortgage to take. A cash-out refinance replaces your existing mortgage with a new home loan for more than you owe on your house. Thats about two-thirds of what you borrowed in interest.

We assume homeowners insurance is a percentage of your overall home value. If youre 10 years into a 30-year mortgage you can refinance the remaining amount to spread those 20 years of payments across 30 years lowering your monthly. Lenders assess different financial factors to gauge your creditworthiness.

To get rid of this added cost many FHA borrowers eventually refinance into a conventional mortgage. Post the pic so I can borrow it. For borrowers trying to decide whether they.

Adjustable-rate Mortgage 10 to 40-year Mortgage VA and FHA Loans. If a house is valued at 180000 a lender would expect a 9000 deposit. 40 11 Nov 20.

How Much You Can Receive 3 Examples A reverse mortgage is a loan that allows borrowers to use a portion of the equity in their homes to obtain cash that requires no monthly repayment for as long as the borrower continues to live. That would give him 1750 a month to put toward a housing payment. Its important to calculate your monthly income and expenses carefully to avoid winding up with a mortgage loan you cant pay in the long run.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. This provides you a ballpark estimate of how much you can borrow from a lender. We use current mortgage information when calculating your home affordability.

All metropolitan postcodes and some regional areas. It takes less than 3 minutes to calculate your borrowing power. Before you can obtain a mortgage you must undergo a qualification process.

Refinancing a mortgage can be costly however these costs can be recouped over time if youre refinancing to a loan with a lower interest rate. Computes minimum interest-only and fully amortizing 30- 15- and 40-year payments. And if youre ready to buy visit our best mortgage lenders page to find the right lender for you.

Your loan amount and mortgage term. For example if your home is worth 250000 and you have 150000 left to pay on your mortgage you have 100000 in equity which you can borrow for a second mortgage. In this example the lender would be willing to offer a loan amount of 171000.

The rate on the 30-year fixed mortgage increased to 581 this week from 578 last week according to Freddie Mac. By 1933 between 40 to 50 of all home loans in the US. The mortgage system was on the verge of total collapse.

If interest rates have fallen since you first got your mortgage a rate-and-term refinance can replace your loan with a new one that has a lower rate meaning. How to borrow from home equity. So the value of the property can also limit how much you can borrow.

You can refinance with the equity you have in your existing home. You can shorten your loan term You can refinance your 30-year mortgage to a 15 year loan to pay it off faster and for less interest overall. Thats about two-thirds of what you borrowed in interest.

The setup fees for the new loan can cost between 300-1000. Riverside Centre 40123 Eagle St Brisbane City QLD 4000. Income stream based on a fraction of 25 of house value each at age 65 then approximately 11.

Available in all 50 states and the District of Columbia. Adjustable-rate Mortgage 15 20 and 30-year Mortgage. Your total interest on a 250000 mortgage.

Second mortgages are sometimes used by home-owners to raise capital for purposes other than buying a second home such as home renovation. 20 of house value at age 65 then 1 each year.

Heloc Calculator Calculate Available Home Equity Wowa Ca

30 Loan Application Forms Jotform

Credit Requirements For A Reverse Mortgage Loan

Should I Take A 15 Yr Or 30 Yr Mortgage Quora

Family Loan Agreement Template Free Family Loan Resume Template Examples

40 Catchy Summer Home Loan Slogans List Phrases Taglines Names Aug 2022

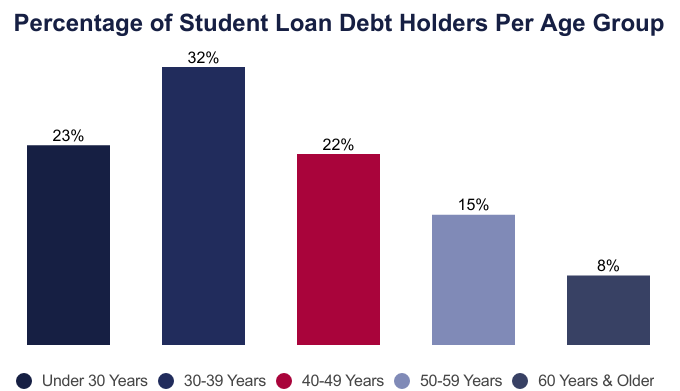

Average Student Loan Debt By Age 2022 Facts Statistics

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

How Does A Loan Origination Software Address The Challenges In The Loan Origination Process Quora

Second Mortgage Lenders Qualifications Rates Wowa Ca

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Personal Loan Contract Template Awesome 40 Free Loan Agreement Templates Word Pdf Template Lab Contract Template Business Rules Personal Loans

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Fbkrro80 Lcsmm

40 Catchy Cash Loan Slogans List Phrases Taglines Names Aug 2022

Reverse Mortgage Guide The Truth About Reverse Mortgages